How Contemporary Art has Beaten the Performance of The S&P 500 the Past 30 Years.

Introduction: When Art Beats the Market

Art has a long history as a transactable commodity with some artist markets and auction houses stretching back many centuries.

But imagine telling your financial advisor in 1995 that your retirement plan involved collecting contemporary art instead of investing in the S&P 500. They might have raised an eyebrow—or both. Yet, fast forward to 2024, and that unconventional strategy might have outperformed traditional stock investments. Let's delve into how contemporary art has not only held its own but surpassed the S&P 500 over nearly three decades.

The Numbers Don't Lie

Between 1995 and 2024 (30 years), contemporary art has demonstrated impressive growth:

Contemporary Art: Average annual return of 14.0%

S&P 500: Average annual return of 9.5%

This means that art enthusiasts who invested wisely could have seen their portfolios flourish, outpacing the returns of standard stock market investments.

‘Contemporary Art’ typically refers to art produced from the mid-20th century to the present. However, the definition can vary slightly depending on context.

Here's a breakdown:

Post-1945 or Post-World War II: Art made after WWII, especially starting around 1945–1950, is considered the beginning of the contemporary era.

Contemporary Art (Strict Definition): Generally considered to be art created from the 1970s to the present day by living artists.

Ultra-Contemporary Art: A newer subcategory referring to art by emerging artists born after 1975, and especially those who began producing major work in the 21st century.

Timeline:

Period

Label

Notes

Pre-1945

Modern Art

Includes Impressionism, Cubism, Surrealism, etc.

1945–1970s

Early Contemporary

Abstract Expressionism, Pop Art, Minimalism

1970s–2000

Contemporary Art

Conceptual, Installation, Feminist, Postmodern works

2000–present

Contemporary/Ultra-Contemporary

Diverse media, digital art, identity politics, global voices

So if you’re talking Art investment, the contemporary art market usually includes works created after 1945, but most investment-grade “contemporary art” tends to focus on art made from the 1970s onward, especially by living or recently deceased artists.

Why Has Art Outperformed?

Several factors contribute to the strong performance of contemporary art:

Low Correlation with Traditional Markets: Art prices often move independently of stock markets, providing diversification benefits.

Tangible Assets: Unlike stocks, art is a physical asset, which can be appealing during times of economic uncertainty.

Cultural and Historical Value: Art can carry cultural significance, adding intrinsic value beyond monetary considerations.

A Change in Values: Contemporary art has soared in value as shifting societal values have transformed it from mere decoration into a powerful status symbol of wealth, taste, and cultural capital.

More Disposable Wealth: Contemporary art has gained popularity as rising disposable wealth—especially among younger, global collectors—has fueled demand for unique, status-enhancing assets beyond traditional investments.

"Old Money" Meets Oil Paint: Art's Centuries-Long Investment Résumé

Let’s zoom out for a second—way out.

Art isn’t just a 1990s-discovered alternative investment. It’s not some new financial hack cooked up by tech bros in a Soho loft. Art has been a power player in the global wealth game for centuries—like, "papal dynasty meets Medici banking empire" centuries.

Think about it: long before the invention of stock tickers, hedge funds, or crypto memes, art was already being used to store, display, and transfer wealth.

🏛️ Art = Currency (But Fancier)

In Renaissance Italy, the Medici family didn’t just fund art because they had good taste—they did it because it signaled power, protected wealth from inflation, and helped cement their legacy. Commissioning a Botticelli back then was the equivalent of acquiring a blue-chip asset with some pretty decent PR perks attached.

Meanwhile, monarchs and emperors across Europe, Asia, and the Middle East used portraits, sculptures, and calligraphy as:

Diplomatic gifts (a Rembrandt beats a fruit basket),

Cross-border currency substitutes (easily transportable, high-value items), and

Wealth anchors during unstable economies.

When the money devalued, the land was seized, or the government collapsed, the art often survived.

💂 “Non-Correlated Asset,” Meet Your Grandfather

Art’s function as a store of value long predates today’s idea of "non-correlated alternative assets." In times of war, regime change, or financial collapse, elite families often protected their fortunes in gold, jewels… and paintings. Why? Because unlike stock certificates or real estate titles, you can roll up a Picasso and smuggle it across a border. (Not that we’re recommending it.)

Even in modern times, look at how post-war collectors like Peggy Guggenheim or David Rockefeller used their art collections as intergenerational wealth vehicles. These weren’t just hobbyists—they were strategic investors in cultural capital.

📈 The Auction Houses: Art's Wall Street

From the 1700s to now, auction houses like Christie’s and Sotheby’s have operated as the stock exchanges of the art world—facilitating trades, tracking historical valuations, and helping art remain a transactable, price-appreciating commodity. Their archives read like the NASDAQ for masterpieces.

Some Old Masters’ works have traded hands more times than a Silicon Valley startup. And the returns, in many cases, have rivaled—or exceeded—those from equities.

Not All That Glitters Is Gold (or Art)

While the returns are enticing, investing in art isn't without challenges:

Illiquidity: Selling art can be time-consuming and may not fetch expected prices.

High Transaction Costs: Auction fees, insurance, and storage can eat into profits.

Market Transparency: Unlike stocks, art valuations can be opaque, making it harder to assess true market value.

Modern Solutions: Fractional Art Investment

For those intrigued by art investment but deterred by high entry costs, platforms like Masterworks offer fractional ownership of artworks. This approach allows investors to buy shares in high-value pieces, democratizing access to the art market.

Conclusion: A Brushstroke of Genius?

Contemporary art's performance from 1995 to 2024 showcases its potential as a viable investment alternative. While it may not be suitable for everyone, and certainly requires due diligence, art investment offers diversification and the allure of owning culturally significant pieces. As with any investment, it's essential to balance passion with prudence.

🎯 What’s Hot on the Canvas: Top-Performing Contemporary Art Categories

Not all art is created equal—especially when it comes to investment returns. While your cousin's finger paintings might hold sentimental value, certain categories of contemporary art have proven to be more lucrative than others. Let's break down which types have been making waves (and profits) in the art market.

🖌️ 1. Paintings: The Crown Jewel of Art Investments

Paintings have consistently led the pack in terms of appreciation. Iconic works by artists like Jean-Michel Basquiat, Yayoi Kusama, and David Hockney have fetched astronomical prices at auctions. For instance, Basquiat's pieces have seen significant value increases over the years, making paintings a staple for serious art investors.

🗿 2. Sculptures: Solid Returns in Three Dimensions

Sculptures, especially those by renowned artists like Jeff Koons and Anish Kapoor, have shown impressive returns. Koons' "Rabbit" sculpture sold for over $91 million in 2019, setting a record for the most expensive work by a living artist at the time. Sculptures offer tangible appeal and have become centerpieces in many high-end collections.

📸 3. Photography: Capturing Value Through the Lens

Fine art photography has gained traction, with works by artists like Cindy Sherman and Andreas Gursky commanding high prices. Gursky's "Rhein II" sold for $4.3 million in 2011, highlighting the potential of photography as a valuable investment category.

🖼️ 4. Prints and Multiples: Accessible Yet Appreciating

Limited edition prints and multiples offer a more accessible entry point for investors. Works by artists such as Banksy and Roy Lichtenstein have seen substantial appreciation. Banksy's prints, for example, have experienced significant price increases, reflecting growing demand in this segment.

🎨 5. Ultra-Contemporary Art: The New Kids on the Block

Artworks created by emerging artists post-2000 have shown remarkable growth. The rise of ultra-contemporary art reflects shifting collector preferences and the dynamic nature of the art market. Investing early in promising new artists can yield significant returns as their reputations grow.

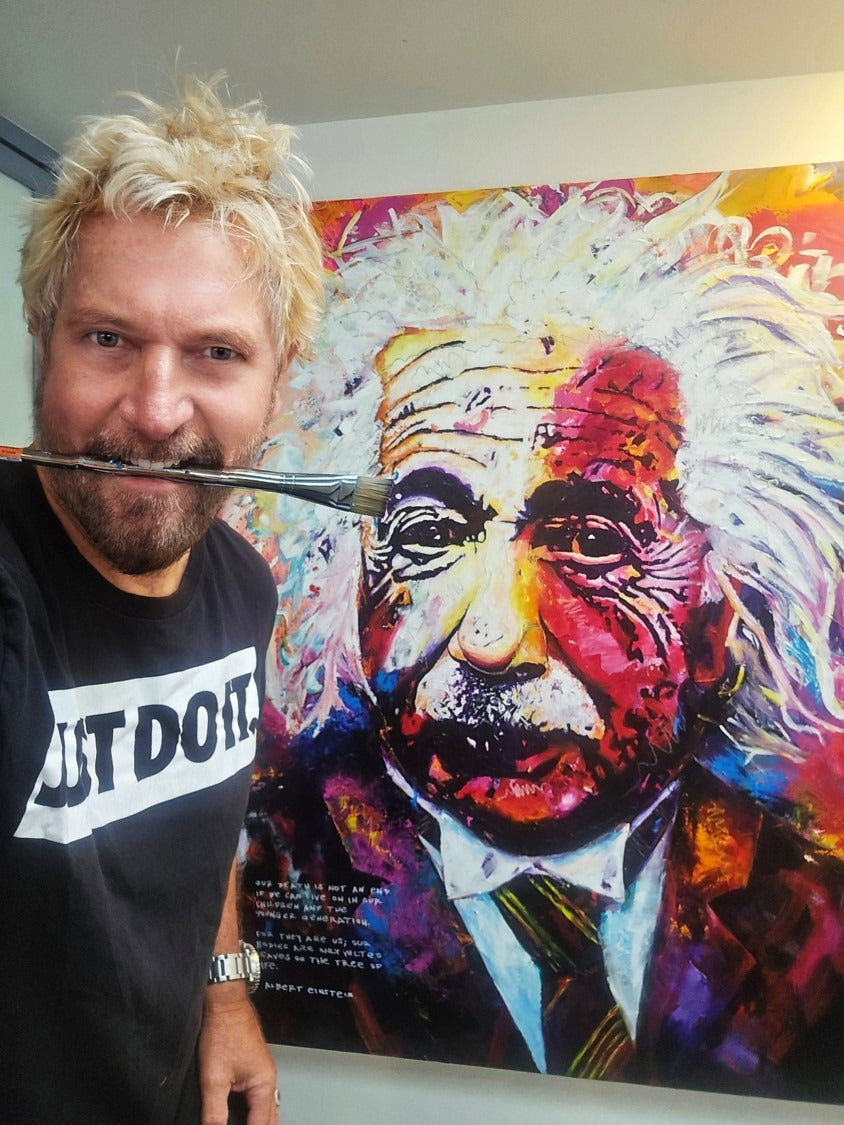

🎨 6. Peter Ashworth Art: Consider Investing in my Art

While I may be a newer name in the art world, my contemporary impact art work is already attracting growing attention and sales—and savvy collectors know that getting in early can yield the greatest long-term rewards. With a bold, distinctive style, expanding global reach, and a strong vision for the next 20 years, my art isn't just something to hang on a wall—it's a chance to be part of something that's gaining value, momentum, and cultural relevance.

Visualizing the Returns:

To provide a clearer picture, here's a chart illustrating the average annual returns of these categories from 1995 to 2024:

Note: This chart is for illustrative purposes and may not reflect exact figures.

In Summary:

While the art market offers diverse opportunities, paintings have historically provided the highest returns, followed by sculptures and photography. Prints and ultra-contemporary works present accessible options with promising appreciation potential. As always, thorough research and a keen eye are essential when navigating the art investment landscape.

Sources:

Carry

The Average Stock Market Returns Since 1928 - Carry

May 5, 2025 — Past 40 years (1984 – 2024): 9.83%. S&P 500 historical performance: Since its inception in 1928, the index has averaged an 8.55% annual return.

WallStreetZen

THIS is How to Invest in Art in 2025 [Identifying Good Investments]

January 23, 2025 — Since 1995, contemporary art has appreciated 11.4% annually on average. That's 43% more than the S&P over the last 30 years (1995-2024). After ...

fortisarborwealth.com

Why Fine Art Has Become a Leading Alternative Investment

December 15, 2024 — Impressive Returns in Contemporary Art Contemporary art has been the standout performer in the art ... S&P 500's 9% return over the same period.

Benzinga

Art's 11.5% Returns Have Outperformed S&P 500 - Benzinga

November 25, 2024 — Between 1995 and 2023, contemporary art has given investors an annual return of 11.5% – nearly 2% more per year than the S&P 500 over the same 28 years.

X (formerly Twitter)

Story (꧁IP꧂) on X: "3. Artue RWA Party Contemporary Art has ...

September 9, 2024 — Artue RWA Party Contemporary Art has boasted 11.5% annual returns from 1995 to 2023, outperforming the S&P 500's 9.6% over the same period.

Maddox Gallery

Bull vs. Bear Markets: How Contemporary Art Performs Across ...

August 26, 2024 — Comparative graph of the Art Market Index vs. the S&P 500 Index from 1978 to 2024, illustrating how Contemporary art has outperformed during ...

Yahoo Finance

These Five Factors Foreshadow A Price Escalation Of A Fine Art Piece

February 21, 2024 — Investing in the S&P 500 from 1995 to 2022 would have netted a comfortable 9% per year on average. In other words, you would've gotten nearly ...

My Money Blog

Contemporary Art vs. S&P 500: Paul Allen's $1.6 Billion Art Sale

November 13, 2022 — The pitch is pretty direct: Contemporary art has outperformed the S&P for the past 25 years, but there has been no way to invest in it.

AltExchange -

This Asset Class Has Outpaced the S&P 500 for 25 Years

May 15, 2022 — From 1995 to 2020, the S&P 500 returned an average of 9.9% per year. Meanwhile, contemporary art returned an average of 14.3% per year during ...

masterworks.com

Why Art - Masterworks - Learn to Invest in Fine Art

Between 1995 and 2022, Contemporary Art specifically has appreciated at a compound annual growth rate of 12.6%, outperforming the S&P 500. Contemporary Art 2 vs ...

masterworks.com

Masterworks - Learn to Invest in Fine Art

From 2001–2023 Contemporary Art outperformed nearly all other alternative assets, while sharing minimal correlation to stocks. Alternatives and Financial ...

Curvo

S&P 500: historical performance from 1992 to 2025 - Curvo

The S&P 500 index had a positive return during 25 of the 32 years (78%) between 1993 and 2024. The histogram shows the frequency of each annual return.

Macrotrends

S&P 500 Index - 90 Year Historical Chart - Macrotrends

Interactive chart of the S&P 500 stock market index since 1927. Historical data is inflation-adjusted using the headline CPI and each data point represents ...

Investopedia

S&P 500 Average Returns and Historical Performance - Investopedia

The S&P 500 has delivered an average annual return of 10.33% since 1957, but when adjusted for inflation, the real return drops to 6.47%. While timing the ...

Facebook

Masterworks - Facebook

EDITOR'S NOTE: Contemporary Art's CAGR is 11.4% from 1995-2024. The S&P 500's CAGR is 11.0% from 1995-2024.

Stern School of Business

Historical Returns on Stocks, Bonds and Bills: 1928-2024 - NYU Stern

S&P 500 (includes dividends), US Small cap (bottom decile), 3-month T.Bill, US ... 1995, 37.20%, 32.27%, 5.49%, 23.48%, 21.29%, 1.79%, 0.98%, $ 61,838.19 ...

Official Data

S&P 500 Returns since 1924 - Inflation Calculator

Stock market returns since 1924. If you invested $100 in the S&P 500 at the beginning of 1924, you would

ScienceDirect

Analysing art as a safe-haven asset in times of crisis - ScienceDirect

April 28, 2025 — The paper examines art's hedging potential during crises using TVP-VAR and wavelet analyses. •. Results indicate that art indices have low ...

ScienceDirect

Invest in Depth or Breadth? The Influence of Multidisciplinary ...

April 17, 2025 — This study examines the impact of interdisciplinarity on the market value and artistic legitimacy of 945 living artists from 2000 to 2020.

Facebook

Did you know that contemporary art is the highest appreciating asset ...

April 15, 2025 — Between 1995 and 2024, contemporary art specifically has appreciated at a compound annual growth rate of 11.2% That's why it's best to buy ...

The Luxury Playbook

Best Artists To Invest In 2025 (ROI & Historical Performance)

March 12, 2025 — How does contemporary art compare to other investment assets? Contemporary art has historically outperformed stocks, bonds, and gold in ...

Newswire

Artmarket.com publishes 30th Art Market Report 2024 - Newswire.ca

March 10, 2025 — Artprice counted 1,131 fine art results above the $1 million threshold in 2024, vs. 1,548 in 2023. 488,210 lots sold for amounts less than ...

Artsy

5 Themes That Will Define the Art Market in 2025 | Artsy

January 12, 2025 — From the return of Donald Trump to increased gallery collaboration, we spotlight five themes that will shape the art market in 2025.

Artsy

The Best Art of 2024, According to Art World Insiders | Artsy

January 5, 2025 — Artsy asked curators, collectors, and artists what the best art of the year was. Here's what they said.

Maddox Gallery

5 Defining Events and Trends that Shaped the Art Market in 2024

December 15, 2024 — The art world in 2024 saw transformative shifts in artistic styles, consumer behaviours and technology driven by innovation and changing cultural and economic ...

Benzinga

Art's 11.5% Returns Have Outperformed S&P 500 - Benzinga

November 25, 2024 — Contemporary art has appreciated at a compound annual rate of 12.6%, outpacing the S&P 500 (9%), gold (5.9%) and other asset classes from 1995 ...

Maddox Gallery

Art as an Asset Class: Maddox unveils a Canvas of Opportunity with ...

September 15, 2024 — In this article, we explore a range of different art investment strategies, each tailored to leverage different aspects of the art world.

Reddit

Is the art world silently collapsing? : r/ContemporaryArt - Reddit

July 18, 2024 — 100% - like "contemporary art" is just art produced since the 1960s. That includes sure, professional, commerical painted works, but it also ...

Timeless

Timeless Guide: How to invest in Art

January 30, 2024 — Explore 2023 art investment trends, value of blue-chip artists, and market insights in our Timeless Guide.

ResearchGate

(PDF) Art Return Rates from Old Master Paintings to Contemporary Art

December 15, 2020 — We study return rates on art investment using a complete dataset on repeated sales for Old Master Paintings, Modern art and Contemporary art ...

masterworks.com

Why Art - Masterworks - Learn to Invest in Fine Art

Between 1995 and 2022, Contemporary Art specifically has appreciated at a compound annual growth rate of 12.6%, outperforming the S&P 500. Contemporary Art 2 vs ...

masterworks.com

Masterworks - Learn to Invest in Fine Art

Jean-Michel Basquiat. From 2001–2023 Contemporary Art outperformed nearly all other alternative assets, while sharing minimal correlation to stocks.

theartmarket.artbasel.com

[PDF] Art Basel and UBS Global Art Market Report 2024

The Art Market 2024 presents the findings of research on the global art and antiques market in 2023. The information presented in the report is based on ...

United States of America

The Art Basel and UBS Art Market Report 2025 | UBS Global

The global art market recorded an estimated USD 57.5 billion in sales in 2024. While total sales value declined 12% year-on-year, the number of transactions ...

SCIRP

Contemporary Art, Twenty-First Century Utopia or Mirror of Everyday ...

Contemporary art is an art of everyday life. It is an art of current reality. It exposes people's daily life

Disclaimer Note: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and past results are not always indicative of future outcomes. This content does not contain legal, tax or investment advice. Always consult with a financial advisor before making investment decisions.

Peter Ashworth is a Southern California impact artist (@peterashworthart) whose purpose is to inspire people to feel alive, take them on a journey of transformation, and help them live their best creative life. Hi purpose is to inspire and uplift people to feel alive through his art, to take them on a journey of transformation, and help them live their best creative life. Contact him for custom artwork commissions, or check out his original art, and high-quality reproduction prints in his store, peterashworth.art

“I want people to feel something when they experience my art.”